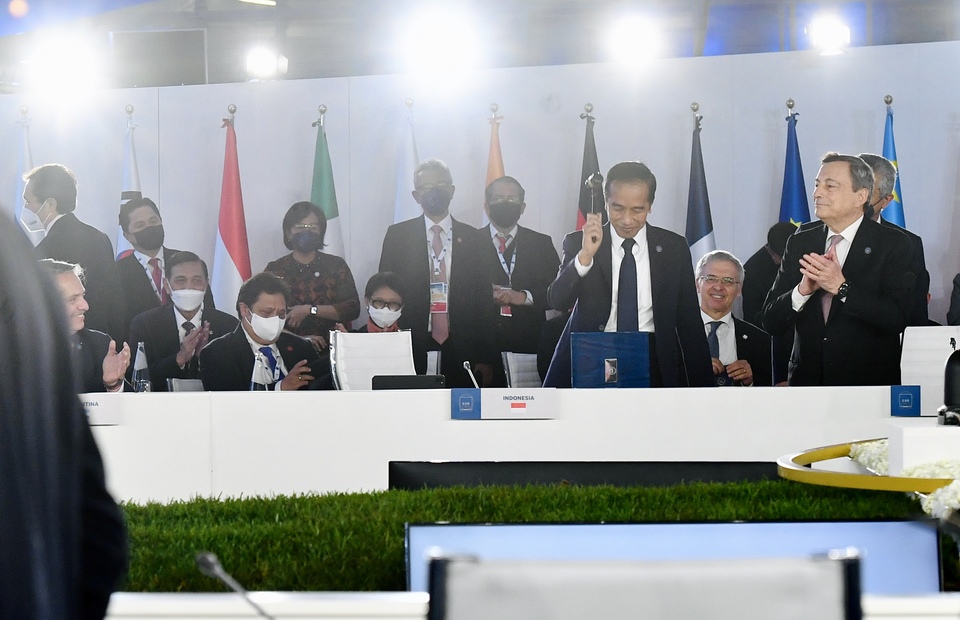

MRCA signed two MoUs during a function at Sofitel Phnom Penh Phokeethra.

It entered into agreements with the Asia Cambodia Law Group and the Association of Guang Dong China Commercial Representative in Cambodia.

Besides Phnom Penh, the trade mission, organised by the Cambodia Embassy in Malaysia and MRCA, plans to visit Kampong Speu province during its four-day trip.

While addressing the delegates, Dr Nhem Khemara, secretary of state, Ministry of Foreign Affairs and International Cooperation, said, “Over the last 65 years, Cambodia-Malaysia bilateral relations have witnessed a significant improvement in various spectrums.

Despite the impact of the Covid-19 pandemic, bilateral trade reached approximately $500 million in 2021, up 13 percent from 2020. Around 162 Malaysian investment projects worth $3.2 billion have been approved so far this year.”

Talking about the significance of the trade mission, Cheuy Vichet, Ambassador of Cambodia to Malaysia, said, “It gives me great pleasure and honour once again to co-lead another trade mission from Malaysia to Cambodia. Our forum today is an excellent venue for tripartite collaboration and partnership between businesses from Cambodia, Malaysia and China.”

For full article, please read here

Author: Adur Pradeep

Source: Khmer Times

According to data from the General Department of Customs and Excise, from January to July this year, Cambodia exported $559 million of goods to Thailand, up 38.36 percent year on year while Thailand’s exports to Cambodia were worth $2.222 billion, up 23.85 percent from the same period in 2021.

Most of Cambodia’s exports to Thailand are agricultural products, while imports from Thailand to Cambodia include automobiles, fuel, construction materials, fertilizers, food products and cosmetics.

In terms of trade balance, Cambodia has a trade deficit with Thailand to the tune of $1.663 billion, or nearly four times greater than its exports.

According to the sixth meeting of the Joint Trade Committee (JTC), the two sides had set a bilateral trade target of $15 billion in 2020.

Hong Vannak, the economic researcher at the Royal Academy of Cambodia, explained that Thailand and Cambodia could not reach the target by 2020 mainly because annual bilateral trade between Cambodia and China rose by over $10 billion.

For full article, please read here

Author: Sok Sithika

Source: Khmer Times

Companies that are committed to reducing their carbon footprint and making progress in green finance should consider having a chief finance and sustainability officer (CFSO), recommends a local accountancy study.

A CFSO would have the chief financial officer and the chief sustainability officer reporting to him or her, whose role would be to integrate finance with sustainability in a company's business strategy.

The high-ranking executive would convert the environmental impact of the company's activities - such as greenhouse gas emissions and pollution - into financial metrics to guide the firm's strategy in meeting sustainability goals.

The CFSO is among an alphabet soup of new green professions - such as an environmental, social and governance (ESG) specialist - that is emerging as the green momentum picks up.

It is an uncommon job role that is present in organisations, such as CapitaLand Investment, that already have well-developed sustainability initiatives and commitments, the report stated.

The new study, Sustainability: Jobs and Skills For The Accountancy Profession, was jointly conducted by the Institute of Singapore Chartered Accountants and three other organisations including the Singapore Management University (SMU).

Its report, released at the annual Professional Accountants in Business Conference on Thursday (Aug 25), shed light on the skills that accountants and finance professionals need in order to perform sustainability-related roles, and where the skill gaps lie.

The study said accountants are well placed for the role of CFSO, as they have the intimate and in-depth finance knowledge to lead their organisation's sustainability agenda.

It said the three trends that are driving finance professionals to expand into the green space are decarbonisation, sustainability reporting and disclosures becoming more widely adopted, and the growth of green finance.

In her keynote speech at the conference, Second Minister for Finance and National Development Indranee Rajah said accountants can lead the charge in pushing their companies to become sustainable.

Their roles in a company would give them the perspective and knowledge to set sustainability ambitions, institute environmental practices that make business sense, and hold their companies accountable for their sustainability pledges.

The report added that sustainability reporting and disclosures, which can involve complex data, are the most pressing challenges for companies now.

Sustainability reporting has been mandated on a "comply or explain" basis by the Singapore Exchange since 2016, and since 2022, climate-related reporting has been mandatory for listed companies.

"As sustainability reporting picks up, there will be demand for accountants to provide assurance and verify these sustainability reports, so as to hold companies accountable for their plans," added Ms Indranee, who is also Minister in the Prime Minister's Office.

To bridge the knowledge gaps for working professionals and students interested in this sector, universities have introduced sustainability modules for accountancy and finance students.

Professor Cheng Qiang, dean of the SMU School of Accountancy, said the curriculum at the school has been adjusted to include content on ESG metrics, to meet the rising demand for sustainability accountants.

But the report concluded that more needs to be done, finding that business and accountancy courses at local institutes of higher learning offer few modules on sustainability and even fewer ones on sustainability reporting, and called for specialised courses or modules.

After 4 years of construction, a drab concrete canal along a section of Sungei Tampines has been given a makeover, and is now a naturalised waterway with greenery.

Rain gardens that help cleanse stormwater run-off, support more native biodiversity and enhance flood protection have been incorporated. Plants grown using soil bio-engineering techniques also help stabilise the soil.

This is just one example of how nature-based solutions and engineered solutions are being integrated to create “green-grey” infrastructure that helps Singapore mitigate and adapt to climate change, said Koh Lian Pin, professor at the National University of Singapore and the director of its Centre for Nature-based Climate Solutions.

Alongside moves to decarbonise the economy through the use of cleaner energy production systems, nature-based solutions are also part of the toolkit in the transition to a circular economy.

Termed “closing the loop” by some, this refers to a production and consumption model where the life cycles of products are extended as long as possible through reuse or recycling.

Nature-based solutions are, simply put, about using nature to improve the state of the world. These solutions could provide over one-third of the cost-effective climate mitigation needed to achieve net-zero emissions by 2050, said GenZero, an investment platform dedicated to decarbonisation solutions.

According to a report by state investment firm Temasek in collaboration with the World Economic Forum and strategic economics consultancy AlphaBeta, nature-based opportunities across 3 systems — food, land, and ocean; infrastructure and the built environment; as well as energy and extractives — could deliver US$4.3 trillion of annual economic value and generate 232 million jobs by 2030 in Asia-Pacific.

Generating power from sunlight bouncing off the ground, working at night, even helping to grow strawberries: solar panel technology is evolving fast as costs plummet for a key segment of the world’s energy transition.

The International Energy Agency says solar will have to scale up significantly this decade to meet the Paris climate target of limiting temperature rises to 1.5 deg Celsius above pre-industrial levels.

The good news is that costs have fallen dramatically.

In a report on solutions earlier this year, the Intergovernmental Panel on Climate Change said solar unit costs had dropped 85 per cent between 2010 and 2019, while wind fell 55 per cent.

“There’s some claim that it’s the cheapest way humans have ever been able to make electricity at scale,” said Gregory Nemet, a professor at the University of Wisconsin-Madison and a lead author on that report.

According to data published by the General Statistics Office, Vietnam's total retail sales of consumer goods and services in the first seven months of the year increased by 16 per cent over the same period last year, reaching more than $139 billion.

Winmart in the first half of this year achieved revenues of more than $608 million, an increase of nearly 6 per cent compared to the same period last year.

WinCommerce, a subsidiary of Masan Group in charge of developing Winmart and Winmart+, said the brand plans to open more than 700 new WinMart+ stores and more than 20 super- or hypermarkets by the end of 2022. It also wants to accelerate with the franchise model towards the goal of holding 10,000 points of ownership and 20,000 franchised stores by 2025.

"We consider this is the time to enter the phase of accelerating expansion after completing the successful rebranding and restructuring. Since the beginning of 2022, there have been more than 300 supermarkets and WinMart, WinMart+ stores newly opened nationwide," said Nguyen Van Quy, deputy general director of the WinMart+ chain.

In addition to expanding its network, the chain also opened a separate brand called Beng's, specialising in convenient, good-quality food at affordable prices.

Other retailers have also planned to expand their investment and system expansion to meet the needs of consumers.

Saigon Co.op, the domestic retailer that owns the Co.op Food, Co.opSmile, and Cheers chains, plans to open 80-100 new points of sale before the end of the year.

Nova Market is still a new name in the retail sector but has opened three stores in the form of small supermarkets selling food, drinks, and fresh vegetables. Its goal is to open 300 stores of various sizes across the country. By 2025, the business is expected to develop 2,000 vendors of sale to increase its presence in all localities.

Despite the market boasting strong development opportunities, not all retail businesses have impressive business results.

After a long period of losses, the Bach Hoa Xanh retail chain under Mobile World Investment Corp (MWG) was forced to close 400 stores in order to restructure.

Bach Hoa Xanh is also one of the domestic brands holding the largest market share in the retail sector. By the end of July, it had 1,735 stores, and revenues in the first 7 months of 2022 reached $660 million, down 14 per cent compared to the same period last year.

Nguyen Duc Tai, chairman of MWG, said that after the restructuring, the experience at Bach Hoa Xanh has improved markedly, and revenues and traffic have increased sharply. In the second quarter, the sales volume of the chain increased by 15-20 per cent and the number of customers coming to the shops increased by 20-25 per cent compared to the first quarter.

“Currently, Bach Hoa Xanh is self-supporting. It is expected that by the fourth quarter, the chain will be profitable," Tai said.

MWG has plans to sell 20 per cent of Bach Hoa Xanh shares to a foreign partner and the deal is expected to be completed in early 2023.

The results of a Global Consumer Insights Survey conducted by PwC in 25 countries and territories, including Vietnam in July, showed that more than 75 per cent of consumers are expected to continue to maintain or increase spending in the next six months, despite high inflation.

The EU-Vietnam Business Network also rated Vietnam third in ASEAN, after Indonesia and Thailand, in terms of retail size.

Source : VIR

Japanese firms Top Planning and Kamya signed deals with the agricultural cooperatives recently, said Poeng Tryda, Director of Agriculture, Forestry and Fisheries Department of Preah Vihear province.

Under the contract, scheduled to be implemented in the harvest season next year, the agricultural cooperatives will supply 100 tonnes of fresh cashew nuts per year, he said, citing that the agreement focuses on the quality and standard requirements of the commodity.

“This is a boon for Preah Vihear province farmers,” he said.

“The contract farming with these two companies will help improve the lives of farmers, especially stabilize market prices,” he said. Under the deal, a tonne of fresh cashew nuts is priced at $1,625.

Fresh cashew nuts from the agricultural cooperatives will be processed at the Chey Sambo Cashew Nut Processing Handicraft in Kampong Thom province and to be supplied to the two Japanese firms, said its president In Lai Huot.

Thirty tonnes of processed cashew nuts will be shipped to the Top Planning and 70 tonnes will go to Kamya, she said. The handicraft, she said, started supplying processed commodities to the Top Planning in March 2021. To date, 45 tonnes of cashew nuts have been shipped to the company which sells in Japan, she said.

Currently, the handicraft in Kampong Thom province is the sole agency having the license for exporting cashew nuts abroad, according to the Cashew Nuts Association of Cambodia, citing that almost all fresh cashew nuts are exported to Vietnam.

For full article, please read here

Author: Chea Vanyuth

Source: Khmer Times

Japanese-owned electronics manufacturer Minebea (Cambodia) Co Ltd has unveiled plans for a $45 million 50MW solar farm to power its production and feed into the national grid, in support of eco-friendly, renewable energy source development.

Minebea Cambodia operates a single factory in the Kingdom, in the Royal Group Phnom Penh Special Economic Zone southwest of the capital’s airport.

At a meeting with Minister of Mines and Energy Suy Sem on August 23, Minebea Cambodia managing director Yoshihiro Sakanushi said his firm’s transition to renewable energy was motivated by commitments to sustainable development made by major clients and partners. He named Apple and Toyota as examples.

Sakanushi said the new project would also support investment and development projects across various sectors in Cambodia.

Ministry director-general for energy Heng Kunleang told The Post that his ministry would support the project as long as Minebea follows the legal principles regarding solar energy development, commenting that the Kingdom aims to increase the use of renewable and eco-friendly energy sources to the “maximum levels” feasible.

“The ministry is developing a master plan for the development of the electricity sector and energy efficiency projects, and is working with the Asian Development Bank to reduce greenhouse gas emissions into the atmosphere, participating in climate change response activities in the energy sector, and supporting a clean-energy transition towards carbon neutrality,” he said.

However, he noted, private investment in the field must be compliant with the Law on Public-Private Partnerships, and regulated under the associated legal framework.

Cambodia Chamber of Commerce vice-president Lim Heng remarked that the high cost of electricity in the Kingdom prompts many private businesses to add solar power to their facilities and stem their expenses.

“Still, solar energy use is low and is not yet able to fully power production processes, due to a total dependence on sunlight,” he said.

According to Yoshihisa Kainuma, CEO of Minebea Cambodia’s parent company MinebeaMitsumi Inc, the company increased its capital investment in Cambodia from about $372 million in 2018 to $400 million in 2019.

For authentic article, please read here

Author: Hom Phanet

Source: The Phnom Penh Post