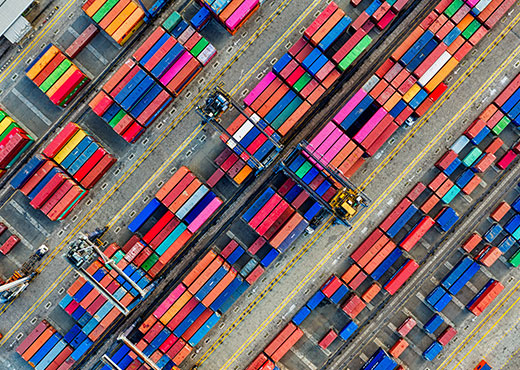

As Thailand's largest trading partner, China has been a major export market for Thailand's various products, a crucial supplier of certain raw materials, components and intermediate products, and an important FDI source for Thailand.

BANGKOK, April 29 (Xinhua) -- China has strong economic resilience and sufficient policy room to deal with downward pressures, while its stable growth is of great significance for Thailand's economic recovery, said a Thai scholar.

As Thailand's largest trading partner, China has been a major export market for Thailand's various products, a crucial supplier of certain raw materials, components and intermediate products, as well as an important source of foreign direct investment for Thailand, Tang Zhimin, director of China ASEAN Studies at the Bangkok-based Panyapiwat Institute of Management, said in an interview with Xinhua.

Tang said Thailand's tourism sector, one of the country's major growth drivers that was hit hard by the pandemic, still takes time to recover, making the country more dependent on exports as the main engine of growth.

"The importance of the Chinese economy's steady operation to Thailand's economic development is self-evident," he said.

The Chinese economy got off to a steady start in the first quarter of 2022, expanding 4.8 percent from one year earlier, despite challenges from an increasingly complex international environment and the resurgence of COVID-19 cases at home.

The hard-won growth, accelerating from the previous quarter and beating the expectations of most economists and market observers, is "quite a good performance," Tang said.

The stable growth of the Chinese economy means its demand for Thai agricultural products and other commodities will increase steadily, which is important for Thailand's economic recovery, he said.

Although there are rising downward pressures on the economy, China has sufficient room to maneuver on fiscal policy to avert a slowdown, he said.

For the longer term, Tang said supported by the innovation-driven development strategy, China's industrial upgrading continued apace and led to strong growth in high-tech sectors such as the high-tech manufacturing and equipment manufacturing industries, laying a solid foundation for the country's high-quality development.

He said China's massive domestic market, resilient industrial and supply chains as well as innovative entrepreneurs are also favorable factors sustaining the country's long-term development.

Sourse : Xinhua