Companies are gearing up for another banner year for deal making.

Mergers and acquisitions hit a record in 2021, fueled by low interest rates, a surge in private-equity fundraising and companies' efforts to respond to broader shifts in their industries.

The total value of global M&A transactions through Dec. 21 was $5.7 trillion, up 64% from the same period a year before, according to Refinitiv, a data provider.

Many of the factors that propelled deal making in 2021 are expected to continue into next year, M&A lawyers and advisers said.

But policy changes on the horizon could damp the pace of corporate tie-ups, including interest-rate increases from the Federal Reserve -- which could increase companies' financing costs -- as well as increased scrutiny from antitrust regulators.

It also remains to be seen if new variants of Covid-19, for example Omicron, have an impact on corporate deal making, advisers said.

"We look at the big trends that have continued over the years and say, 'Are they more likely to continue or not?' And our conclusion is that, generally speaking, they are likely to continue going into next year." said David Harding, advisory partner at Bain & Co., a professional services firm.

Throughout the year, companies tapped into cash piles that they amassed early on during the pandemic to pursue M&A.

Cash and equivalents at companies in the S&P 500 increased 11% during the third quarter, to about $3.78 trillion, compared with the prior-year period, according to S&P Global Market Intelligence.

Blockbuster transactions included AT&T Inc. and Discovery Inc.'s decision to merge their media assets into a new, publicly traded company.

Under the deal, AT&T will receive $43 billion, and AT&T shareholders will own 71% of the new company once the transaction closes.

Other big deals included Square Inc.'s move this summer to purchase buy-now-pay-later company Afterpay Ltd. for $29 billion, as well as Oracle Corp.'s agreement last week to acquire medical records company Cerner Corp. for $28.3 billion.

Square earlier this month renamed itself to Block Inc.

Finance chiefs at acquiring companies have contended with high valuations in deciding whether to commit to a transaction.

"What's different about now versus prior booms is…there's less price sensitivity, particularly in the technology industry,'' said Michael Diz, co-chair of the mergers and acquisitions group at law firm Debevoise & Plimpton LLP.

Multiples for transactions -- calculated as the ratio of median enterprise value to earnings before interest, taxes, depreciation and amortization -- increased across industries in 2021 compared with the prior year, according to Bain. The technology and healthcare sectors commanded the highest multiples, with 28 times and 24 times, respectively.

ChargePoint Holdings Inc., a Campbell, California-based maker of electric vehicle charging stations, closed on two acquisitions this year to expand its operations in Europe.

It acquired software firm Has-to-be for approximately €250 million, equivalent to around $283 million, in cash and stock, and bought ViriCiti, a fleet-electrification company, for about €75 million.

The company approached the two deals with the intention to be choosy, chief financial officer Rex Jackson said.

"It's going to be expensive because the space is richly valued, so let's make sure we get what we want," Mr. Jackson said, discussing the company's selection of targets.

Many companies during the pandemic revisited their portfolios and entered 2021 with a plan to sell business lines or buy companies as a means to expand. For instance, some companies acquired technology firms to improve their digital capabilities, while others scooped up competitors to expand sales.

Signet Jewelers Ltd. in November acquired Charlotte, N.C.-based Diamonds Direct USA Inc., a bridal jewelry retailer, for $490 million in cash.

The deal is meant to help Signet increase sales of what it calls "accessible luxury," according to Joan Hilson, the company's finance chief.

"The market is doing quite well in that tier, and we believe that we have room to take more share there," Ms. Hilson said.

Mergers with special-purpose acquisition companies this year accounted for 11% of transaction values globally through Dec. 8, up from 6% in the full-year 2020, according to Bain's analysis of data from Dealogic, a financial information company.

The surge in investor interest in SPACs this year is expected to spur additional deal making in 2022, since the firms, which are essentially publicly traded pools of cash, typically have a two-year window to make an acquisition.

SPACs can act as a broader stimulus for deal making by prompting firms that might not have been ready to sell to consider transactions, according to Brian Salsberg, global head of the integration practice at professional services firm Ernst & Young.

Private-equity and venture-capital firms also increased their share of total M&A transaction values in 2021 by about two percentage points from 2020, to 19% and 8%, respectively, Bain said.

Looking ahead to 2022, a host of economic factors suggest deal making will remain strong, including growing U.S. gross domestic product, strong corporate earnings and large corporate cash balances, said Colin Wittmer, U.S. deals leader at accounting and consulting firm PricewaterhouseCoopers.

Still, U.S. regulators are applying more scrutiny to large transactions, particularly in the technology sector, deal advisers said.

The Federal Trade Commission earlier this month sued to block U.S. chip maker Nvidia Corp.'s proposed acquisition of Arm Holdings, a semiconductor firm.

FTC chairwoman Lina Khan has said she aims to challenge more corporate mergers and allegedly monopolistic practices.

Companies nonetheless are looking for ways to put the cash they have raised during the pandemic to work, advisers said.

U.S. investment-grade bond sales declined slightly in 2021 from their peak in 2020, when companies built up liquidity to weather the economic shock caused by the pandemic.

Businesses raised $1.4 trillion through Dec. 21 by selling such bonds, down 22% from a year earlier, Refinitiv said.

The continuing surge in private-equity funding will also be a factor in M&A in 2022, particularly in the technology and healthcare sectors, advisers said.

Private-equity and venture-capital firms globally raised about $1 trillion through Dec. 21, up 35% from the end of 2020, according to Refinitiv.

It is too soon to say whether next year will surpass the M&A records set in 2021, but corporate advisers said there appear to be few factors to significantly slow it down.

Source: https://www.bangkokpost.com/business/2238731/global-ma-activity-likely-to-remain-strong-in-2022

Singapore and the United Kingdom (UK) have substantially concluded negotiations on the UK-Singapore Digital Economy Agreement (UKSDEA) on Thursday.

The agreement covers key areas of the digital economy, such as data, as well as a wide range of emerging and innovative areas such as artificial intelligence, fintech, digital identities and legal technology, according to a statement jointly issued by Singapore's Ministry of Trade and Industry, the Ministry of Communications and Information and the Infocomm Media Development Authority.

Here is a look at some of the key features of the agreement and how they will help businesses and consumers.

1. Electronic payments (e-payments)

Promote rules for development of software that allow two applications to talk to each other and adopt internationally accepted standards to promote interoperability between e-payment systems.

2. Paperless trading

Accept electronic versions of trade documents, facilitate cross-border digitalisation of supply chains, and promote interoperability of electronic documents such as bills of lading and invoices. This will enable faster and cheaper transactions, and reduce costs for businesses.

3. Cross-border data flows

Businesses in the two countries will be allowed to transfer information, including those which are generated or held by financial institutions, more seamlessly across borders with the assurance that they meet the requisite regulations.

4. Prohibit data localisation

This essentially means that both countries will allow businesses to choose where their data is stored.

5. Cryptography

This refers to protecting information by transforming it into a secure format. Neither country will require the transfer of, or access to, technologies used in cryptography by a company as a condition of market access.

6. Online consumer protection

Adopt or maintain laws and regulations that guard against fraudulent, misleading or deceptive conduct that causes harm to consumers engaged in online commercial activities.

7. Small and medium-sized enterprises cooperation

Singapore and the UK will seek to cooperate in promoting jobs and growth for SMEs, as well as encourage their participation in e-commerce platforms that will help link them with international suppliers, buyers, and potential business partners.

Source: The Straits Times (Singapore)

Reference: https://www.straitstimes.com/business/economy/how-the-uk-singapore-digital-trade-deal-will-help-businesses-consumers

The Biden administration aims to sign what could prove a "very powerful" economic framework agreement with Asian nations - focusing on areas including coordination on supply chains, export controls and standards for artificial intelligence - next year, Commerce Secretary Gina Raimondo said.

"It's a priority for the president," Raimondo, speaking in a roundtable discussion on Thursday at Bloomberg headquarters in New York, said of deepening US engagement with Asia. "America didn't show up in that region for four years," she said, alluding to the Trump administration's record.

Raimondo said that her trip to Asia last month was designed to "assess appetite" for economic dialog, under the condition that President Joe Biden's team isn't planning to take up traditional trade talks. She underscored that rejoining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership "as presented" is off the table.

"The demand for US presence and the demand for US reengagement was off the charts," said Raimondo, who stopped in Singapore, Malaysia and Japan last month. What the administration envisions is a "new kind of economic framework for a new economy," and the hope is to, "early in the new year, first quarter of next year, officially launch a process," she said.

The framework will be "flexible," with some countries perhaps not signing up to all of the elements, Raimondo said.

She said the aim is to engage not just developed nations such as Japan, Singapore, Australia and New Zealand but also emerging economies such as Malaysia, Vietnam and Thailand.

"I would love 12 months from now to be coming back here with something signed saying we've made progress," the Commerce chief said. She said the agreement may not "culminate" in something that would require approval by the US Congress - which is needed for traditional trade agreements.

"It won't be a trade deal, but it could be very powerful."

Supply chains for critical goods including semiconductors are a particular focus, Raimondo said. The goal is "robust, long-term collaborations around supply chains" that addresses what has been a lack of coordination among producers and users, she said.

On the domestic US front, Raimondo cited the benefit of the government convening "stakeholders" at the same table to increase transparency and trust around supply chains.

The Democratic former governor of Rhode Island also said that she could see some non-American companies benefiting from the US$54 billion of emergency appropriations to help bring semiconductor manufacturing back to the US that Congress is now debating. The key is that the production is done in the US, she said.

"It is a problem for America that we are so reliant on Taiwan" for semiconductors today, Raimondo said.

Another element of the Asia economic framework is working to harmonize export controls to limit sensitive products that head to China "and other autocratic regimes," Raimondo said. "The devil is deeply in the details" on export controls, she also said, because measures shouldn't be "overly broad," such that they deny revenue that companies need to plow into their research and development.

"If America puts export controls vis-a-vis China on a certain part of our semiconductor equipment, but our allies don't do the same thing, and China can therefore get that equipment from our ally, that's not effective," Raimondo said.

A third area for the new framework is writing technical standards and rules for artificial intelligence and cybersecurity, Raimondo said. "Working with our allies to together define the standards of what is responsible, ethical artificial intelligence - that's massively valuable."

Chinese Foreign Ministry spokesman Wang Wenbin said Friday at a regular press briefing in Beijing that the US has been abusing its power to politicise issues involving trade and technology.

He also accused Washington of trying to "set up barriers to undermine international rules and sever the global market."

It's unclear whether what the Biden administration envisions meets the level of economic engagement that some Asian economies have called for. Japan and others have urged Washington to reconsider former President Donald Trump's decision to pull out of the CPTPP deal, which had been the key economic pillar of a strategy to bolster US-led opposition to China.

Singapore Deputy Prime Minister Heng Swee Keat said last week that while "over the past decades, the US security presence has brought stability and peace in the region," for that to stretch "into the next decades, the US cannot afford to be absent from the region's evolving economic architecture." BLOOMBERG

Source: The Business Times (Singapore)

Reference: https://www.businesstimes.com.sg/government-economy/us-eyes-powerful-asia-economic-deal-in-2022

AS a region familiar with the fearsome potential of natural disasters - 80 per cent of the Asean region is surrounded by water and is prone to water-related disasters - the heat has been on, both literally and figuratively to tackle climate change.

One of the ways economies are doing this is by pouring more investments into renewable energy, improving their urban planning, and reducing consumption.

According to the report Southeast Asia's Green Economy: Opportunities On The Road To Net Zero, South-east Asia needs US$2 trillion of investment this decade to cut emissions and remain competitive globally.

Released in September, the report, by Bain & Company, Microsoft and Temasek Holdings, also noted that acting now could lead to about US$1 trillion in economic opportunities with new growth areas contributing about 6 to 8 per cent to the region's gross domestic product (GDP) by 2030.

It also picked up on 3 areas the region should focus on: transiting to green energy; valuing nature; and transforming the agri-food sector to make it more efficient, less polluting and less environmentally damaging.

Within the renewable energy space, solar power is one of the fastest growing energy sources in the region largely due to how quickly it can be rolled out, said Jasper Wong, head of construction and infrastructure, sector solutions group at UOB.

It also helps that the cost of solar installation has dropped significantly. According to Data from the International Renewable Energy Agency (Irena), solar photovoltaics showed the sharpest cost decline over 2010-2019 at 82 per cent.

Concentrating solar power ranked second at 47 per cent, followed by onshore wind (40 per cent) and offshore wind at 29 per cent.

"You can roll out rooftop solar in 3 months or less. Ground-mounted solar panels, depending on how big the size is, can be done within 18 months," said Wong.

"Meanwhile, a 600 MW gas-fired power plant will take three and a half to 4 years before it can generate electricity," he said.

"Solar is quite interesting in that once you finish a section, as long as the power is connected to an inverter and the grid, you can start sending power to the grid. It can be scaled up thereafter. That's the beauty of solar projects."

A hot market

South-east Asia is prime for renewable energy growth, said UOB. With countries in the region having renewable energy targets of up to 37 per cent of total energy mix by 2037, this translates to more than 125 gigawatt of renewable energy capacity installation between 2020 and 2040.

Solar is expected to be one of the fastest growth areas at 6.5 per cent per annum accounting for close to a third of the total new renewable energy capacity installed, said Wong.

Indeed, their solar financing programme U-Solar has facilitated the generation of 210 gigawatt hours of solar power across Asean as at August 2021, since its launch in October 2019.

This has helped reduce more than 113,000 tonnes of CO2-equivalent greenhouse gas emissions - equivalent to having close to 1.87 million new tree seedlings grow over 10 years or taking close to 25,000 cars off the road for a year.

Their U-Solar Programme is available in Singapore, Malaysia, Thailand and Indonesia. They currently have 15 partners, and are onboarding "1 or 2 more" in the first quarter of next year.

Their programme has attracted numerous awards including the Asset Triple A Country Awards for Best Green Loan in Thailand (Sustainable Finance) in 2020; a Special Award for Sustainable Financing (Conventional Financing) at the Ministry of Energy and Natural Resources Malaysia's Energy Energy Awards 2020; and the Asian Banking & Finance Wholesale Banking Awards' Singapore Domestic Initiative of the Year in 2021.

U-Solar was also selected as a winner in the Sustainable Solutions, Non-SME Category in the 2021 Singapore Apex Corporate Sustainability Awards.

Just as importantly, the impact is being felt on the ground.

Charlotte's Beauty Lounge in Jakarta, Indonesia, for instance, installed 6 kW solar system on their rooftop and saw their electricity bill, which was about S$500 per month, halved.

"Plus, because they only operate 6 days a week, they sold the electricity they generated back to the grid. So on top of (the savings), they were able to sell back to the grid and get certain rebates from the electricity company for selling green power to the community," said Wong.

The green way forward

In preparation for the 26th United Nations Climate Change Conference of the Parties (COP26) which commenced on Oct 31, Asean member states released a joint statement that reaffirmed their commitments to tackle the climate emergency.

They also highlighted that the region had achieved 21 per cent energy intensity reduction, surpassing its aspirational target of 13.9 per cent renewable energy share.

Earlier this year, Singapore launched the Singapore Green Plan 2030, the national roadmap towards sustainable development and net-zero emissions.

Solar energy solutions provider Sunseap Group has secured a S$85.8 million loan for its SolarNova 4 project to install solar photovoltaic systems across more than 1,200 public housing blocks and 49 government sites.

The loans are provided by UOB and DBS Bank, utilising Sunseap's Green Financing Framework. SolarNova 4, which has a capacity of 70 megawatts-peak (MWp) (potentially up to 102 MWp).

It is estimated to generate 96,775 megawatt-hour (MWh), equivalent to powering up to 20,400 public housing 4-room flats and potentially offset more than 68,583 tonnes of carbon emissions per annum.

"This is quite significant because given Singapore's size, you don't usually see a lot of ability to scale up for rooftop solar," said Wong.

The country has turned to creative ways to harvest more solar energy. These include the world's largest inland floating solar farms at Tengeh Reservoir, and trialling the use of vertical solar panels.

Separately, the Energy Market Authority has granted in-principle approval on a pilot project to import 100 MW of solar power from Indonesia to Singapore.

Neighbouring countries like Malaysia and Thailand have also traditionally been supportive with their sustainable policies, noted Wong.

Indonesia meanwhile, has unveiled an ambitious 2021 electricity supply business plan (2021 RUPTL), the country's first-ever shift from relying mostly on fossil fuel generation towards renewables.

Vietnam notably made substantial progress to its energy capacity since 2018, with a large component of it being renewable solar power. Last year, they pulled off a 25-fold increase in its solar capacity, with incentives for homes and businesses to install rooftop solar panels leading to the boom, as reported by the World Economic Forum.

"We have financed 24 MW in Vietnam already, for local Vietnamese corporates on a rooftop basis," said Wong.

"This is something we want to do more and we're looking at helping UOB Vietnam scale up their solar lending programme."

Source: The Business Times (Singapore)

Reference: https://www.businesstimes.com.sg/companies-markets/solar-powering-renewable-targets-in-asean

One hundred fifteen engagements between the private sector and ASEAN sectoral bodies as well as the ASEAN Secretariat took place from January to mid-November 2021, marking an increase of 64% compared to the engagements held in 2020. This December issue of ASEAN for Business Bimonthly Bulletin highlights the private sector's involvement and contribution to building the ASEAN Economic Community (AEC) in 2021.

Laos has officially announced it will reopen for tourism on 1 January 2022, providing more information on travel conditions during a press conference held at the Lao National Convention Center today.

According to the Ministry of Information, Culture, and Tourism, the reopening will be implemented in three phases.

The first phase will be from 1 January to 30 March 2022, the second phase from 1 April 2022 to 30 June 2022, and the third phase from 1 July 2022 onward.

According to the ministry, tourists from an initial list of countries will be allowed to travel to the country during the first phase.

The list of countries includes China, Vietnam, Cambodia, Thailand, Malaysia, Singapore, South Korea, Japan, France, United Kingdom, Germany, the Netherlands, Spain, Italy, United States, Canada, and Australia.

Tourism will be restricted to group tours at first, with tours arranged by authorized tour operators under the Lao Travel Green Zone Plan.

Tourists will be required to have been fully vaccinated against Covid-19 no less than 14 days prior to arrival. Other conditions include a health insurance policy with coverage no less than USD 50,000 and a negative RT-PCR test taken within the last 72 hours.

Arrivals will be tested for Covid-19 and placed in a 24-hour quarantine in their hotel until a negative result is found.

Tourists will be required to download and register via the LaoKYC and the LaoStaySafe mobile applications prior to arriving in the country, as well as uploading their relevant vaccination certification and Covid-19 test results...

Source: Laotian Times

cr: laotiantimes.

KUALA LUMPUR, December 11 – SME and Entrepreneurs Business Awards (SEBA), an annual initiative organised by Yayasan Usahawan Malaysia that aims to recognise Malaysia’s most notable companies and entrepreneurs, is back once again. In partnership with Celcom Business, Yayasan Usahawan Malaysian hosted their 6th Grand Awards Gala Evening on the 9th of December 2021, at the Shangri-La Hotel, Kuala Lumpur.

Over 350 guests attended the event to witness the unveiling of this year’s most outstanding entrepreneurs, SMEs and businesses. Among the many that attended the gala dinner were Tan Sri Noh Haji Omar, Minister of Entrepreneur Development and Cooperatives (MEDAC), Dato’ Suriani Ahmad, Secretary General of MEDAC, and all the Board of Advisors of SEBA 2021. A total of 42 prestigious awards were presented to various SMEs and entrepreneurs hailing from numerous industries.

In line with the external challenges that many businesses have had to experience recently, this year’s event was themed, ‘Thriving the Waves’. SEBA believes this period of emergence from the pandemic is the best time to recognise businesses that have thriving despite the many obstacles. Among the award recipients at the Gala Evening, Dato’ Sri Hajah Siti Nurhaliza Binti Tajuddin was awarded the Entrepreneur of The Year Award, Mr. Shahrul Anuar Bin Zain was presented with the Lifetime Achievement Award in the Music Industry, and Mr. Leslie Gomez, from the Olive Tree Group was awarded with the title Excellence in Leadership.

In his welcoming speech, Tan Sri Noh Haji Omar, Minister of MEDAC said, “Yayasan Usahawan Malaysia recognises entrepreneurs who have succeeded in cementing their names within their respective industries and simultaneously elevating Malaysia in the global arena. This is a commendable effort and must be collectively supported.” He further added, “I believe this is a good starting point for entrepreneurs who are bravely facing the challenges on the road to success.

MEDAC is confident that the vision and mission of achieving an entrepreneurial nation will succeed with the cooperation and teamwork from various backgrounds in line with the concept of Keluarga Malaysia. On behalf of the Ministry of Entrepreneur Development and Cooperatives, I call on all Malaysian families to unite with a concerted effort to restore the Malaysian economy which has been impacted by COVID-19. Hopefully, the efforts made by Yayasan Usahawan Malaysia, will continue to be a catalyst for other entrepreneurs to successfully navigate the efforts that have been carried out.

During SEBA 2021, Yayasan Usahawan Malaysia also officially launched their e-magazine, “Asia Connects”. The publication aims to create an enhanced platform for further regional growth prospects as we move towards a post pandemic recovery. This year, SEBA added several new categories, starting with the Halal-preneur Award and the Young Entrepreneur Award. Aiming to adapt and evolve with the times, and as the halal sector is a rising segment within the industry, for the first time, SEBA will be honouring entrepreneurs who have successfully empowered their community in general, within the Halal sector. On the other hand, the Young Entrepreneur Award is designed to empower the youths of today and encourage early entrepreneurship in the community.

On 9th December 2021, the Vietnam Digital Awards 2021 was jointly held by Vietnam Digital Communication Association and eMagazine VietTimes . The Agency for Enterprise Development – Ministry of Planning and Investment has been honored “ Outstanding digital transformation state agencies, public units ” with the Business Portal at www.business.gov.vn.

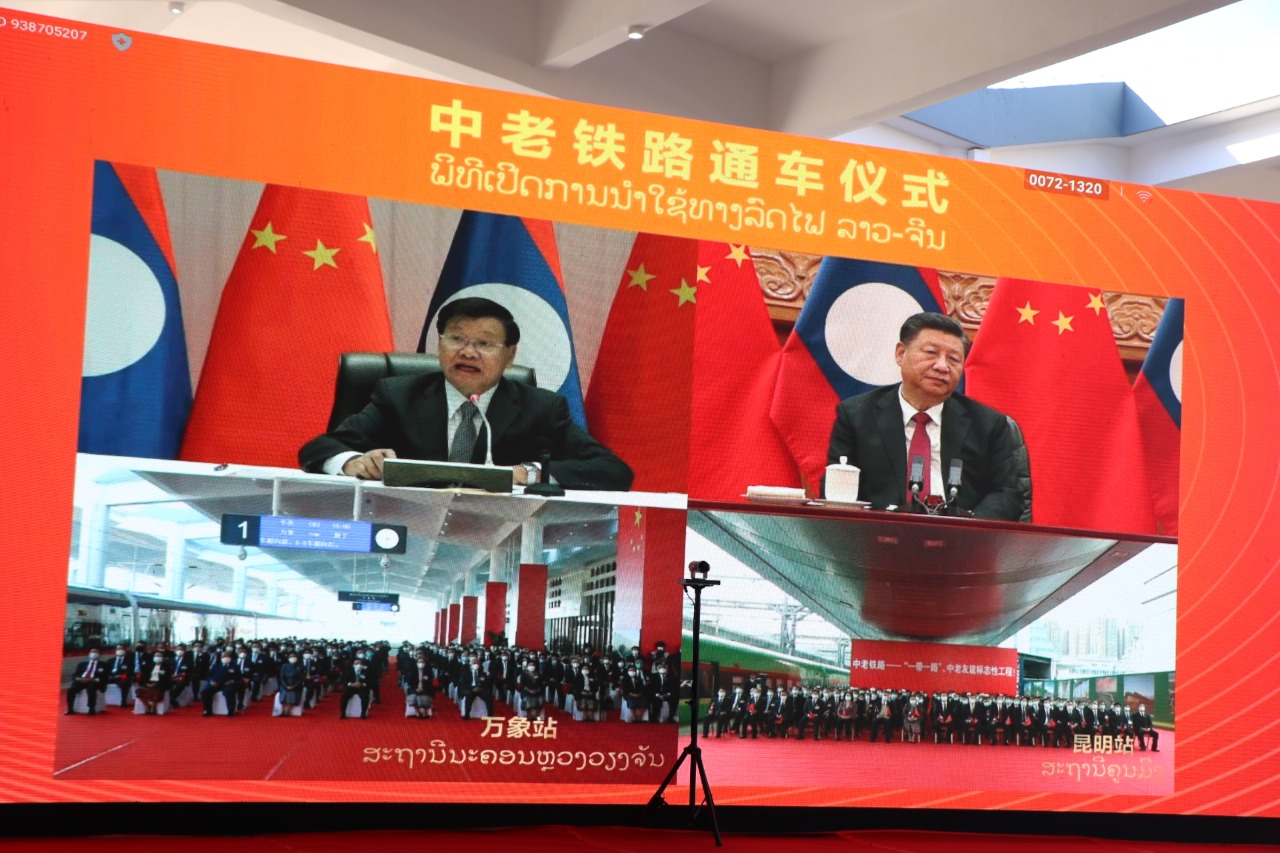

The landmark railway has seen Laos transform from a landlocked country to a land-linked nation, opening up new opportunities for trade and travel.

Lao President Thongloun Sisoulith spoke during a live broadcast from the National Cultural Hall, while invited guests attended the launch of the railway at Vientiane Station.

At the same time, President Xi Jinping was broadcast from Beijing, while a train stood ready to depart from Xishuangbanna Railway Station, in Kunming.

“This ceremony marks a monumental and historic milestone in the development of modern infrastructure for Laos. It’s a proud moment for the Lao people to realize this dream,” said President Thongloun Sisoulith.

He said that the Laos-China Railway is a wonderful gift for the Lao people on the occasion of its National Day, and that the railway would bring about new conditions for the comprehensive development of Laos.

Read for the full article HERE

The Cambodia Chamber of Commerce and the Philippine Chamber of Commerce have agreed to promote and strengthen business and economic cooperation.

The two parties signed a Memorandum of Understanding recently. Kith Meng, President of Cambodia Chamber of Commerce and AMB. Benedicto V. Yujuico, President of the Philippine Chamber of Commerce were the signatories.

The virtual MoU signing was held during the 3rd Meeting of the Cambodia-Philippines Joint Commission for Bilateral Cooperation (JCBC) and witnessed by Prak Sokhonn, Deputy Prime Minister, Minister of Foreign Affairs and International Cooperation and Honorable Teodoro L. Locsin Jr., Secretary of Foreign Affairs of the Republic of the Philippines.

The MoU is aimed to promote and strengthen business and economic cooperation between Cambodia and the Philippines in various fields such as ICT and innovation, agriculture, manufacturing, franchising, tourism, services, and SME development, read a press release.

“Both chambers will regularly exchange information, organise trade and investment mission, hold seminar and conferences, organise exhibitions and arrange business matchings,” it added.

Both chambers agreed to establish a Philippines-Cambodia Business Council based in the Philippines and Cambodia-Philippines Business Council in Cambodia that will meet to discuss, plan, and implement joint initiatives.

For full article, please read here

Author: Chea Vannak – AKP

Source: Khmer Times

Publication date: 8 December 2021