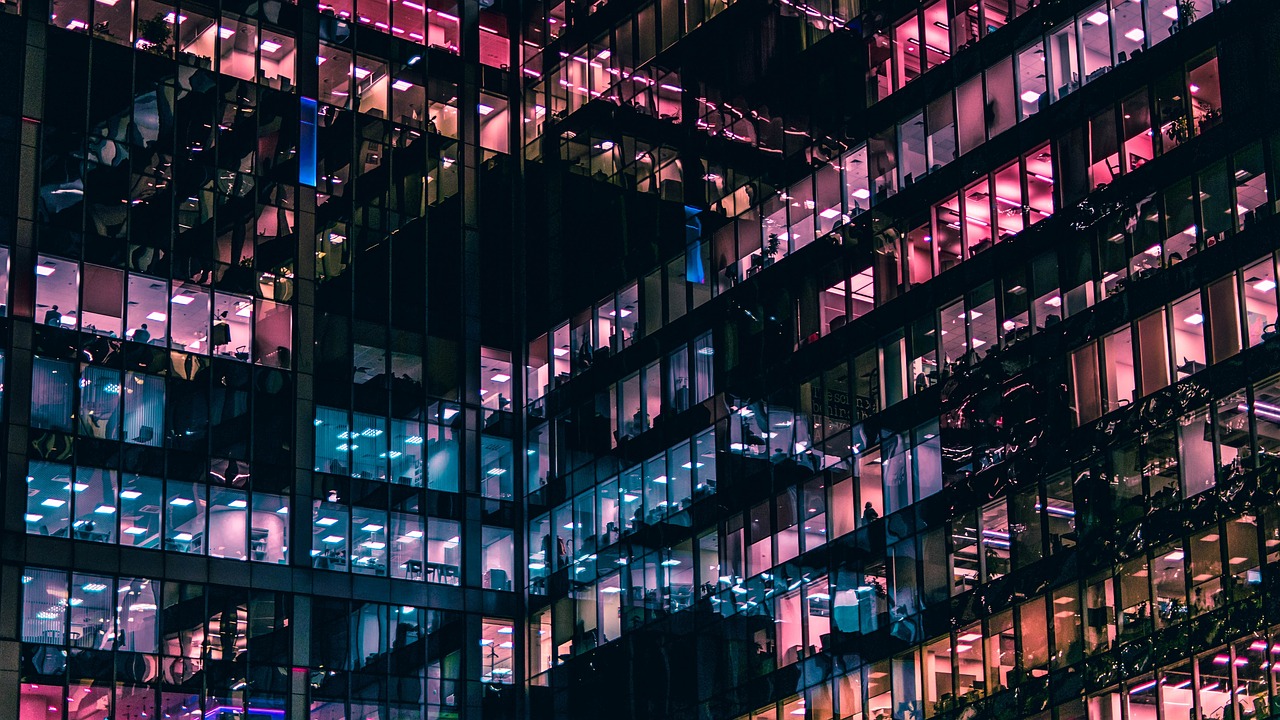

Ongoing supply chain disruptions in the ASEAN region, caused by various factors including China's COVID-19 strategy and global geopolitical tensions, are costing the region a staggering $17.01b annually, as per the analysis by business transformation consultancy TMX Global.

TMX Global Asia Managing Director Dean Jones highlighted that these disruptions are affecting an average of 0.47% of business revenue worldwide.

The research revealed that Singapore, Malaysia, and Thailand were adversely affected by negative supply and demand shocks compared to smaller economies like Brunei and Myanmar.

Despite this, ASEAN’s gross domestic product is forecasted to more than quadruple over the next two decades, increasing to $13.3t by 2040 driven by both exports and domestic demand.

According to Jones, the reopening of China in December has provided significant relief to global brands that are still manufacturing out of Asia. It is perceived as a positive sign of further easing from the immense pressure faced by global supply chains.

The supply chain disruptions, particularly in 2022, have resulted in increased consideration of ASEAN's role in anticipating future volatilities in the global supply chain landscape. As a result, businesses are increasingly adopting a 'China Plus One' strategy by diversifying their operations, such as production centres and warehouses outside of China.

Malaysia, India, Thailand, and Vietnam are now the top choices for businesses to set up their operations as they witness opportunities to become global manufacturing and shipping centres.

“Whilst all these put the region at an advantage, it also means that businesses in the region should all the more not let their guard down when it comes to ensuring supply chain resilience,” Jones warned.

“ASEAN cannot afford to rest on the laurels of its geographic, regulatory, economic, and demographic advantages if it wants to continue the fast track to lead on global trade. Supply chains thrive on predictability, and so the ability to take away as much of the uncertainty as possible through a resilient supply chain is crucial,” he said.

Source: Asian Business Review. Link Here.